Business Insurance in and around Georgetown

Georgetown! Look no further for small business insurance.

Helping insure small businesses since 1935

Your Search For Remarkable Small Business Insurance Ends Now.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and extra liability coverage, among others.

Georgetown! Look no further for small business insurance.

Helping insure small businesses since 1935

Protect Your Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a pizza parlor, a music school, or a sign painting company, having the right protection for you is important. As a business owner, as well, State Farm agent Stephanie Featherstone understands and is happy to offer exceptional service to fit the needs of you and your business.

Get right down to business by getting in touch with agent Stephanie Featherstone's team to review your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

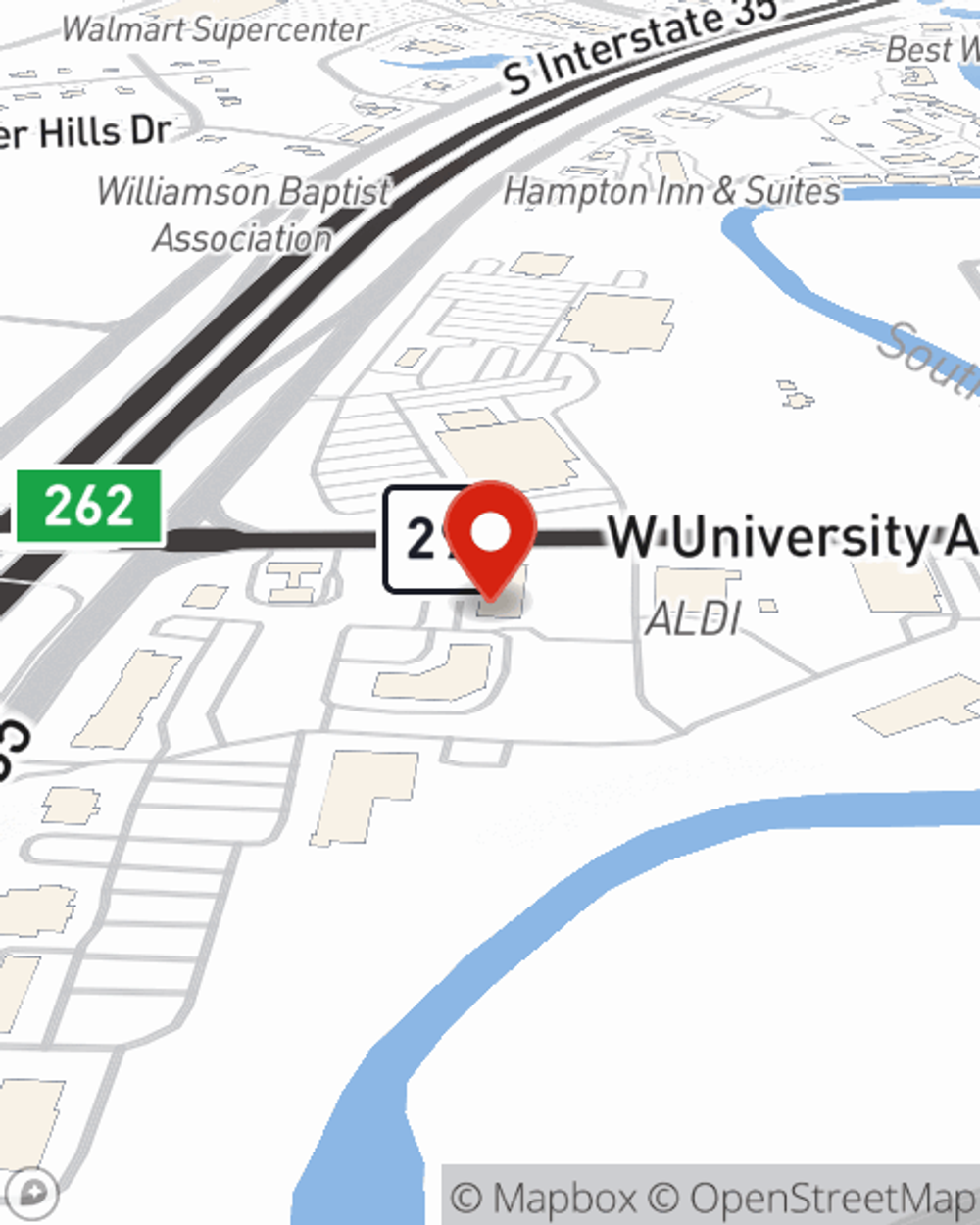

Stephanie Featherstone

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.